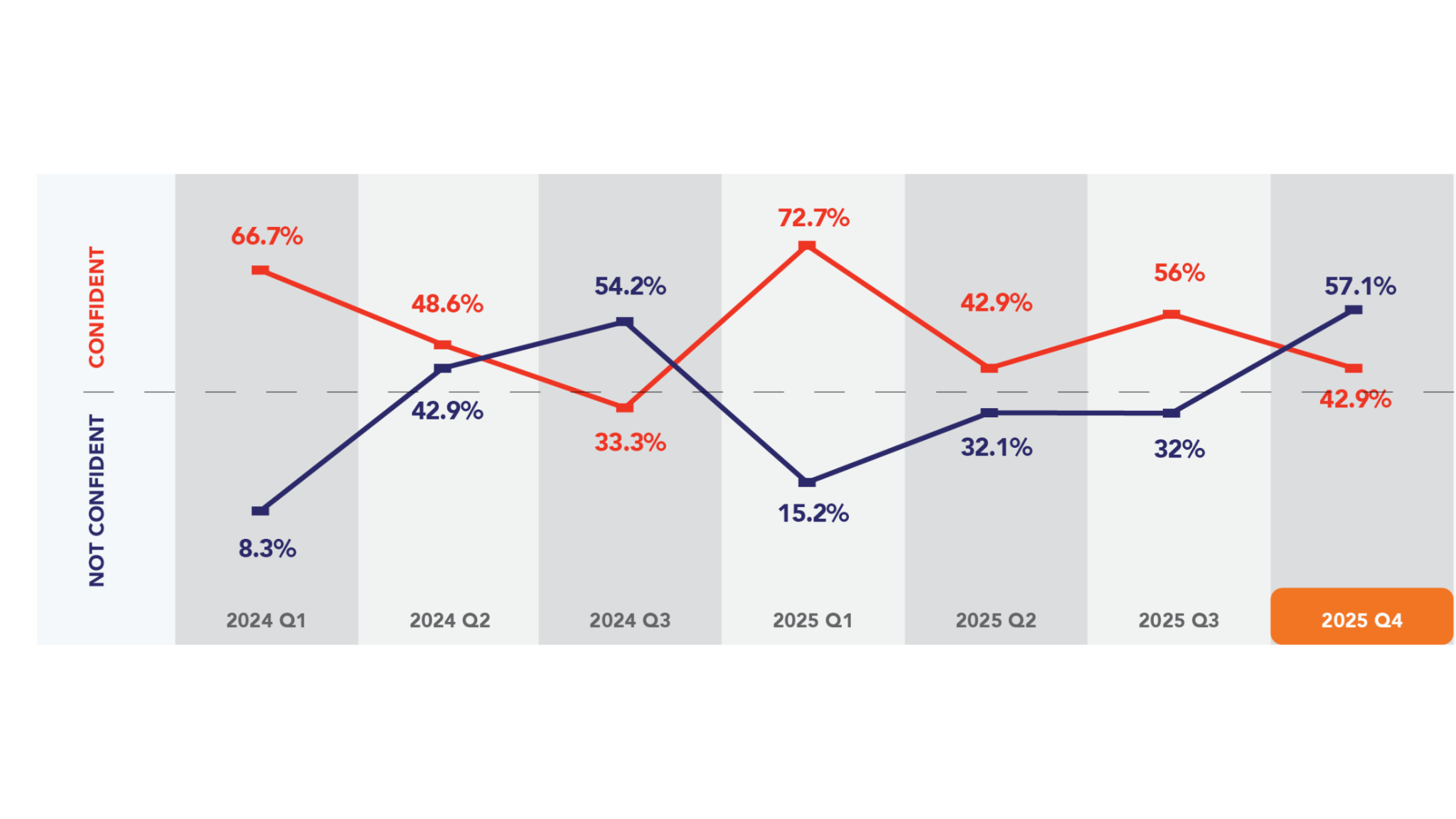

In the franchise industry, market sentiment is a critical leading indicator. Surveys—including our own Quarterly Confidence Index—give us a pulse on how franchisors are feeling about the future.

But sentiment is only half the story. To get the full picture, you need to pair confidence with data.

As the financial verification partner for over 300 franchisors—ranging from emerging concepts to global QSR leaders—BoeFly possesses a singular view of the franchise market’s actual buying power.

In 2025 alone, we verified over $18 billion in candidate net worth across our client network.

This analysis moves beyond sentiment and self-reported estimates. Every dollar in this report is predicated on data verified directly against actual bank and brokerage statements.

When we analyzed the financial position of the 2025 franchisee applicant pool across the entire market, the data revealed a clear shift: the “quality floor” for franchise deals has risen significantly.

Sentiment vs. Reality: Why is Liquidity Rising?

Our confidence surveys have shown that franchisors are cautiously optimistic, but this verified data reveals how the market is adapting to the economic reality.

The surge in verified deal liquidity is driven by three converging factors:

- Inflationary Entry Costs: Rising build-out costs have naturally filtered for stronger operators who can absorb higher initial investments.

- Market Performance: With major indices like the S&P 500 reaching new highs, candidate portfolios—specifically verified Marketable Securities—have appreciated significantly, boosting accessible liquidity.

- Monetary Policy: Years of M2 (money supply) expansion continue to support elevated individual balance sheets.

The Data: 2024 vs. 2025 Project Benchmarks

The following table represents the Median Verified Project Liquidity & Net Worth for unique franchise applicant groups in 2025 compared to 2024.

Note: These figures reflect the total capital verified for a deal, often capturing multi-partner groups.

| Sector | Median Project Liquidity ‘24 vs ‘25 | Median Project Net Worth‘24 vs ‘25 | Trend (Liquidity) |

| QSR | $293k ⮕ $386k | $907k ⮕ $1.16M | +32% |

| Health & Wellness | $280k ⮕ $300k | $943k ⮕ $1.04M | +7% |

| Auto Repair | $238k ⮕ $253k | $727k ⮕ $866k | +6% |

| Home Services | $125k ⮕ $153k | $639k ⮕ $756k | +22% |

| Retail | $398k ⮕ $531k | $1.20M ⮕ $1.23M | +33% |

Key Takeaways for Franchisors

1. QSR & Retail: The Era of the “Capital Group”

The most dramatic shift occurred in QSR (+32% Liquidity) and Retail (+33% Liquidity). With QSR project liquidity approaching $400k, it is clear that the “single operator with a HELOC” is increasingly being replaced by partnerships, family offices, and multi-unit investors. If your lead flow feels “richer” than last year, you aren’t imagining it—the capital required to play in this space has fundamentally shifted.

2. The “800 Club” in Home Services

For years, a 700+ credit score was the benchmark. Today, it’s just the baseline. In 2025, verified median credit scores for Home Services candidates broke the 800 barrier (Median: 804). This sector is attracting highly disciplined, creditworthy operators who are entering the market with pristine personal balance sheets.

3. A “Flight to Quality” Across the Board

Across every sector analyzed, the data shows a consolidation of capital. Emerging brands and established players alike are seeing fewer “stretch” candidates and more fully capitalized groups. This signals a healthier, more resilient franchise industry heading into 2026, as these stronger operators are better positioned to weather economic fluctuations.

Benchmarking Your Brand

Knowing the industry average is helpful context. But knowing how your applicant pool stacks against direct competitors’ median liquidity may change your entire development strategy.

That is why we are introducing Custom Benchmarking.

We are now helping our client partners move beyond generic industry data to compare their portfolios against custom peer groups.

- You define the category (e.g., “Sandwich Brands” or “Top 20 QSRs”).

- We aggregate the verified data.

- You get the strategic edge.

Your Data Remains Confidential. We understand the sensitivity of financial data. Our benchmarking model aggregates competitive sets to ensure anonymity. You will see how you stack up against the average of your chosen peer group, but your specific brand data is never shared with competitors, nor is their specific data shared with you.

If you are interested in a custom analysis of your 2025 candidate portfolio, reach out to our team. Let’s put the industry’s most powerful verified dataset to work for you.