December 30, 2025 – The longest federal government shutdown in United States history—43 days—didn’t help the development outlook among franchisors who responded to the latest survey from BoeFly.

More than 71 percent of respondents surveyed for BoeFly’s Franchise Growth Confidence Index said the government shutdown, which went from October 1 to November 12, and corresponding effects on the Small Business Administration, negatively impacted their brand’s growth plans. The SBA said it was unable to deliver $5.3 billion to 10,000 small businesses during the shutdown.

BoeFly CEO Mike Rozman said there was likely some anxiety on the part of franchisors working to get on the SBA’s Franchise Directory, which was reinstated in June after being eliminated in 2023. It’s available to lenders for use in evaluating businesses for loans and financing.

“And there were franchisees who needed to get financing and weren’t able to because of the shutdown,” said Rozman of what contributed to negative outlook.

BoeFly conducted its survey of nearly 700 franchisor chief executive, chief financial and chief development officers November 1-20, with respondents coming from several industries including automotive, education, fitness, health and beauty, home services, restaurants and retail. BoeFly helps franchisors qualify their applicants and also connects those candidates with lending options.

he survey likewise showed franchisors are more worried about the impacts of interest rates and inflation than they were in July, and are less confident they’ll meet growth goals this year. More than 70 percent said interest rates negatively impacted growth plans, up from 64 percent, and almost 62 percent agreed the current inflation rate adversely affected growth.

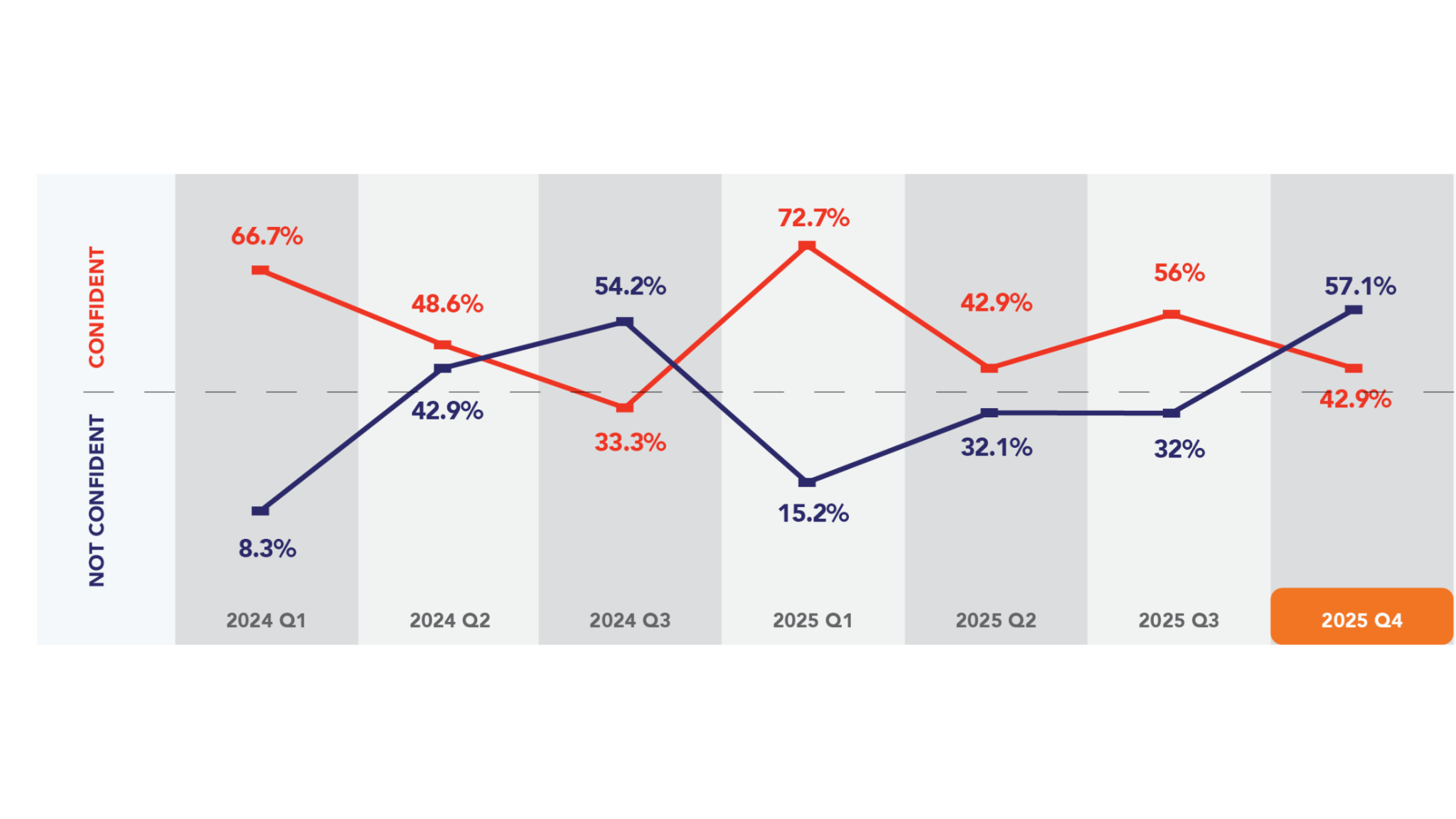

Overall confidence among C-suiters in achieving growth goals for 2025 dipped to 42.8 percent, down 13.2 percent from the prior period.

The average SBA loan interest rate “probably begins with a nine,” Rozman said, “and there is still pushback from the franchise prospect that says it feels like a pricey interest rate for me to get into a franchise. I think franchisors are still sensitive that interest rates are historically on the higher side from where they’ve been over the last 15 years.”

Jennifer Durham, hired in November as senior vice president of franchising at Potbelly, said 2025 was tough as many franchisees felt “unsettled” about where the economy was headed. They saw a fatigued consumer, and as a result brands lost some development momentum.

Potbelly completed 35 openings on the year, she noted, and under new parent RaceTrac, which acquired the sandwich brand in October, there are co-development opportunities with that company’s network of convenience stores.