Methodology

Continuing in the assessment of the impact of current economic conditions on franchisors’ growth, BoeFly released its latest quarterly Franchise Growth Confidence Index. This quarterly report evaluates survey results by measuring franchisor executive confidence related to domestic growth goals. The survey was conducted from February 12 – 25, 2024, and reached nearly 700 CEOs, CFOs, and CDOs of franchised brands across several major industries, including automotive, education, fitness, health/beauty, home services, restaurant, and retail. BoeFly has utilized this data to measure any significant changes in franchisor sentiment regarding the state of franchise growth in the U.S.

In line with previous surveys, participants were asked to share their confidence on a scale of 1 (not confident) to 7 (completely confident) as to whether they anticipate their respective brand will meet growth goals this year. Respondents were then asked four supporting questions with relevant economic concerns in mind to gauge which conditions, if any, have an impact on their confidence level.

Results

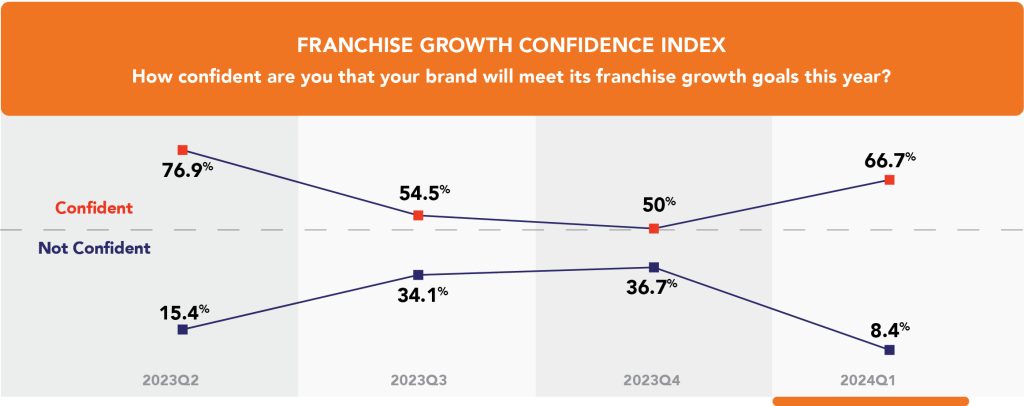

Overall, a majority of respondents (66.7%) reported they are at least confident that they will meet their franchise growth goals for the year. This was a significant shift from the previous quarter’s results in which the total confidence levels of respondents when combined reached just 50%. Further insights include:

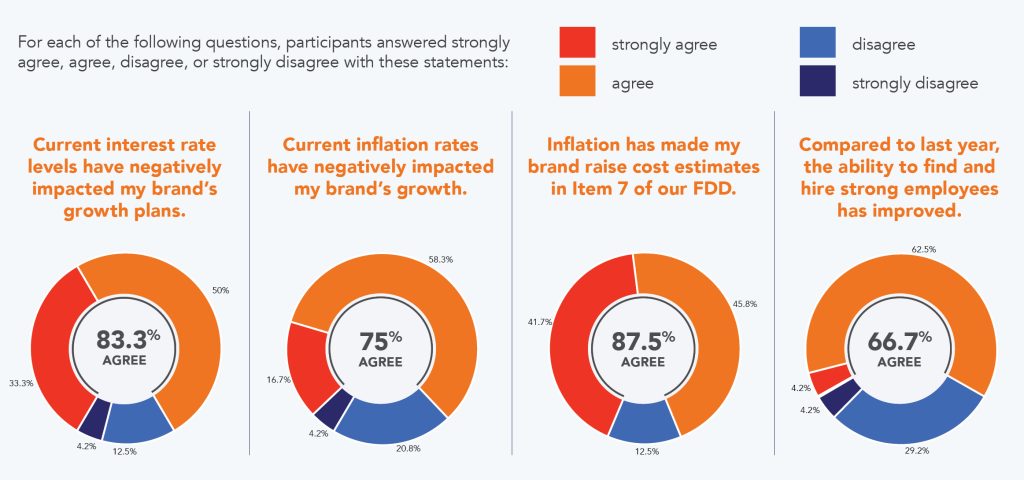

- A clear majority (75%) of those surveyed significantly agreed that inflation has negatively impacted their growth goals. When looking at the relationship between inflation and its effect on cost estimates, a notable 87.5% of respondents agreed that inflation has caused their brand to raise cost estimates in Item 7 of respective Franchise Disclosure Documents (FDDs).

- As interest rates and inflation continue to play a key role in franchisors’ economic concerns quarter over quarter, the level at which interest rates impacted respondents has only slightly decreased by 3.3% from the previous quarter. A clear majority of 83.3% of respondents indicated that interest rates continue to have a negative impact on their confidence levels.

- Amid labor concerns, the majority of franchisor executives (66.7%) agreed that the ability to find and hire strong employees has improved when compared to the previous year. However, it’s important to note that this is nearly a 10% decrease (from 75%) when assessing the previous time respondents were surveyed about whether the ability to find and hire strong employees had improved.