In December, the Federal Reserve reduced the federal funds rate by .25%, the third reduction since September. The new federal funds target rate is 4.25% to 4.5%. Lower interest rates sound good, but how do they actually impact franchisees looking to borrow and franchisors looking to develop more units? And should borrowers wait to secure financing in case interest rates drop again? Keep reading to learn more about how BoeFly can make franchise lending work for you, regardless of current interest rates.

What are the federal funds and WSJ prime rates?

The Federal Reserve dictates how much excess money a bank must have on hand to back up their deposits. The extra money can be lent overnight to other banks that need more cash on hand to meet their reserve requirements. The interest rate on these loans is called the federal funds rate.1

The Wall Street Journal (WSJ) conducts a regular survey of America’s largest banks to see what interest rates they are charging their “prime” customers (those with the highest credit scores) for short-term loans.2 The WSJ does not actually set the rate; it just reports it. The paper has been publishing the prime rate since 1947, causing it to be called the WSJ prime rate in financial circles. The WSJ prime rate adjusts along with the federal funds rate and is currently at 7.5%.

What is the impact of interest rates on franchising?

Small Business Administration (SBA) loans are based on the WSJ prime rate. Most typical SBA loan rates reset quarterly, so a rate change is passed along to borrowers in the quarter that follows the adjustment. “The fact that SBA loans are typically variable rates is a distinct advantage for franchisees when rates are expected to drop,” says David Canet, Managing Director of SBA Lending at ConnectOne Bank.

A reduction in the federal funds rate has a positive impact on franchise financing for both franchisees and franchisors.

Benefits to franchisees include:

- Lower borrowing costs thanks to lower interest rates on SBA loans.

- More obtainable funding because banks often see lower rates as a sign of a healthy economy, so they often ease loan qualification requirements as a result.

- Better cash flow due to smaller loan payment amounts.

Benefits to franchisors include:

- More interest in franchising as lower rates make it more profitable for franchisees to expand.

- More financial stability as franchisees have lower loan payments, giving them more cash on hand to reinvest in their business and develop additional locations.

Should franchisees wait to secure a loan in case the rate drops again?

With three rate decreases since September, it can be tempting to wait and see if you can try and time your investment to get the best rate possible. And while the hope is that there will be another drop, there’s no guarantee. When you’re considering options for franchise financing, it’s best to turn to the lending experts at BoeFly. They will help you find the best loan for your individual situation. “We’re seeing a small, select group of lenders getting more aggressive on setting the borrower’s interest rate in order to grow their portfolio,” says BoeFly’s Senior Director of Funding Services Brooke Ingram. “It’s important that franchisees have access to an array of lenders to ensure that they’re getting the best rate.”

Can franchisors expect a bump in new franchise applications?

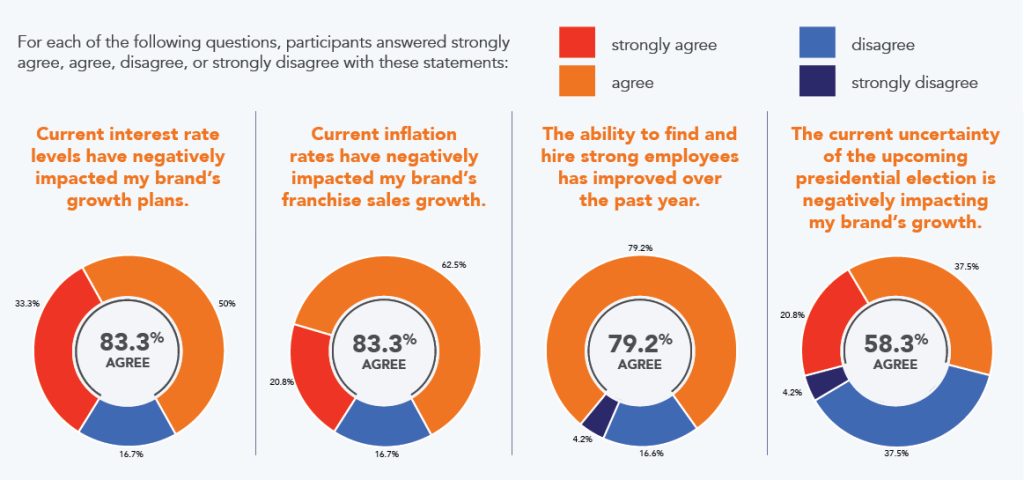

The Franchise Growth Index is BoeFly’s quarterly survey that measures how certain economic conditions and external factors are affecting franchisors’ growth. Results for Q3 showed that 83.3% of respondents felt negatively impacted by interest rates. A drop in the WSJ prime rate is surely encouraging news for businesses. “Prospective franchisees have been closely watching interest rates,” says Senior Vice President of Franchise Sales and Development at The Joint Chiropractic Eric Simon. “Now that rates are dropping, we’re seeing more leads coming into our pipeline.”

BoeFly is here to help

Navigating interest rates and the small business loan process can be overwhelming. Whether you’re a franchisee looking for a lender or a franchisor that wants to increase sales, the franchise financing experts at BoeFly are here for you. Click on the link that best describes you below and fill out the form to get started.

Sources:

1 apstylebook.com